There are many ways for womenpreneurs to get a jump on funds to start or grow their businesses. Funding options include traditional bank loans, venture capital, angel investors, and more!

Finding out which funding option is right for you depends on your business goals and stage of development. It’s essential to research the costs associated with each type of funding and what conditions might be attached to your options. Here are some ideas on where to start when looking for money to begin your next business venture or help your current business grow!

The challenges womenpreneurs face when seeking funding.

Womenpreneurs often find it more difficult than their male counterparts to secure funding from investors. There are several reasons for this, including that women in business are less likely to be taken seriously by potential investors, and they’re typically asked to prove their business acumen and financial stability. Women must overcome this authority gap if they want to succeed in growing their businesses.

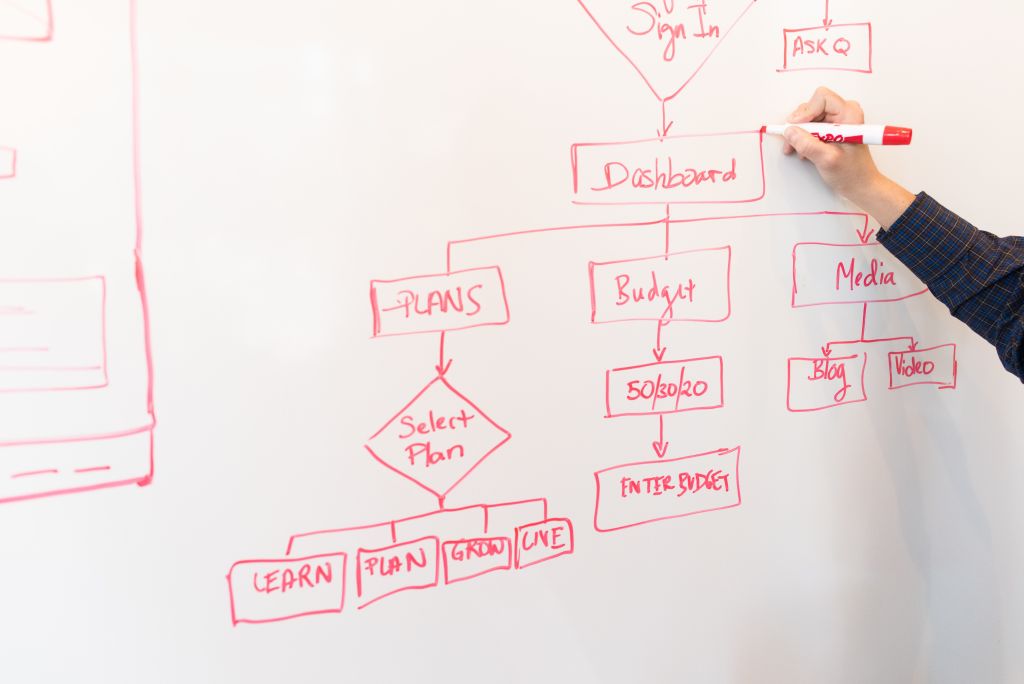

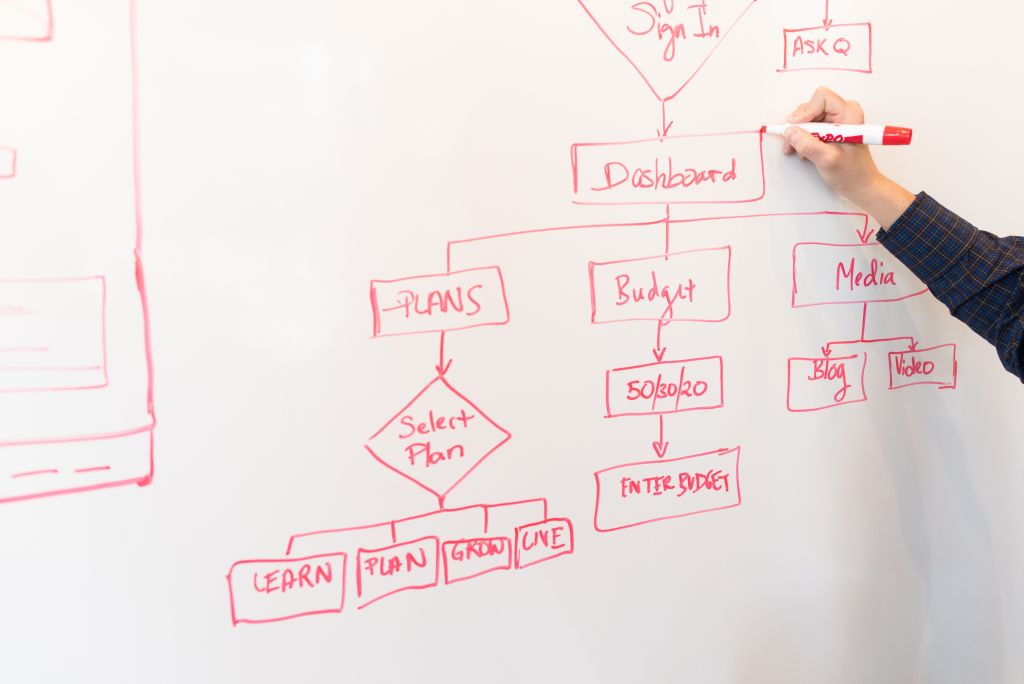

To overcome this gap, you’ll need to understand and be able to explain the ins and outs of not only your daily business operations but other businesses within your industry. Have answers in mind to questions such as:

- How does your business make a profit?

- How do your company and industry employees typically write and manage a budget?

- What is your business strategy, and how do you choose based on your plan?

If you have brief answers to any of these questions that often come up, you’ll be able to make more people sit up and listen when it comes to finding funds to run your business.

How to find the right funding source for your business

There are several funding sources for female-owned businesses. The Small Business Administration (SBA) offers several loans and grants specifically designed for women entrepreneurs, including the Women’s Entrepreneurship Development Program Loan and the 8(a) Business Development Program. Other means of funding include venture capitalists, angel investors, or asking friends and family for help.

More traditional routes to finding funding options for female-run businesses involve expanding into more inclusive approval structures. This includes small business loans from many big-name banks and credit card companies that offer higher rewards and cash back if you use their card on purchases from women-owned small businesses.

Regardless of your funding option, it’s essential to research to find the right funding source that will meet your needs and fit your business plan accordingly. Weigh your options and decide whether you can afford to borrow money or need to start with grants or crowdfunding first.

What to do when your application is rejected

When your loan application is rejected, don’t give up! You can do many things to improve your chances of approval the next time.

Find opportunities to participate in organizations such as the International Council for Small Businesses (ICSB) and attend conferences where you can network with other womenpreneurs. By joining in with other like-minded business owners who know and experience the same struggles you face, you’ll find a meaningful support group. Often, you’ll find peers who have reached their business goals and want to invest in other women to help raise them to the same level of success!

Approach the friends, family, and fools (FFFs) in your network and see if they’re able and interested in investing in your business to help get you off the ground or through a difficult stage of growth. Don’t feel like you’ve failed if you have to take this approach! You’ll be among the 35-40% of startups and businesses that raise money similarly.

How to negotiate with potential investors

A few things to remember when negotiating with potential investors as a woman. First, be confident in what you’re offering, and make sure to set goals with realistic expectations. Be clear about what you need from the investor, and be prepared to answer any questions they may have. Most importantly, don’t be afraid to speak up for yourself – know your value and advocate for it!

Investors can be broken up into two groups: venture capitalists and angel investors. Going into a meeting with different investors will require different approaches. Here are two scenarios to keep in mind:

Venture Capitalists:

Often, a newer business looking to grow will seek additional help from venture capitalists. Show them how you’re managing your money. If they see you handling your finances well, they’ll see you as someone they can trust with their money in the form of investment. Return on investment (ROI) is your main focus here.

Angel Investors:

Startups often approach angel investors either right after or before opening their doors. In this case, showcase your team, the novelty of your business idea, and the potential traction your idea can generate. If they like your current energy and potential for growth, they’ll be more likely to invest in your venture.

Tips for creating a successful pitch deck

Going into an investor meeting can be nerve-wracking. If you’re worried about missing the mark when making a first impression, make sure to follow these four tips when putting together your pitch deck:

- Make sure it’s visually appealing and easy to read. Use clear and concise language, and don’t overload the viewer with too much information at once.

- Focus on telling a compelling story that showcases why your business is worth investing in.

- Be clear about what problem you’re solving, how you’re doing it differently than others, and what kind of potential return investors can expect.

- Always be prepared to answer questions from viewers of your deck! Anticipate common concerns and be ready to address them clearly and succinctly.

How to keep your business finances in order

Keeping your business finances in order is essential to ensure that your company remains successful. There are a few key things you can do to make sure this happens:

- Make sure all expenses and income are documented and tracked correctly. This will help you understand how your company is performing financially over time.

- Set aside money for unexpected costs or emergencies. It’s always important to be prepared for the worst-case scenario, even if it doesn’t happen often.

- Make a habit of leaving yourself enough breathing room in the budget for unexpected minor expenses, so you don’t have to scramble for funds or rely on credit cards to carry you over from month to month.

Closing Thoughts

Womenpreneurs still face unique challenges when accessing capital and other financial support. This is especially true for women who operate businesses in traditionally male-dominated industries or sectors. To help level the playing field for womenpreneurs, we must continue working together to create policies and programs to support entrepreneurship among women!

Dr. Ayman El Tarabishy

President & CEO, ICSB

Deputy Chair, Department of Management, GW School of Business