Tuesday, September 1, 2020, by Michael Guta

The top women entrepreneurs and female founders in the U.S. are doing well, but there is a considerable gap from top to bottom. But there is an even bigger gap between what male and female founders receive in funding.

According to PitchBook, in 2019 only 2.8% of the companies founded solely by women secured the total capital invested in venture-backed startups in the US. It goes up by almost 10% (12.4%) when it is co-founded by female and male entrepreneurs.

As bleak as this might seem, this hasn’t stopped female founders from going after their dreams. And when they do, they deliver better returns for their investors. A study from the Boston Consulting Group revealed startups founded by women generated 78 cents in revenue for every dollar of investment compared to only 31 cents for male-run startups. So, how are female founders doing in the U.S.?

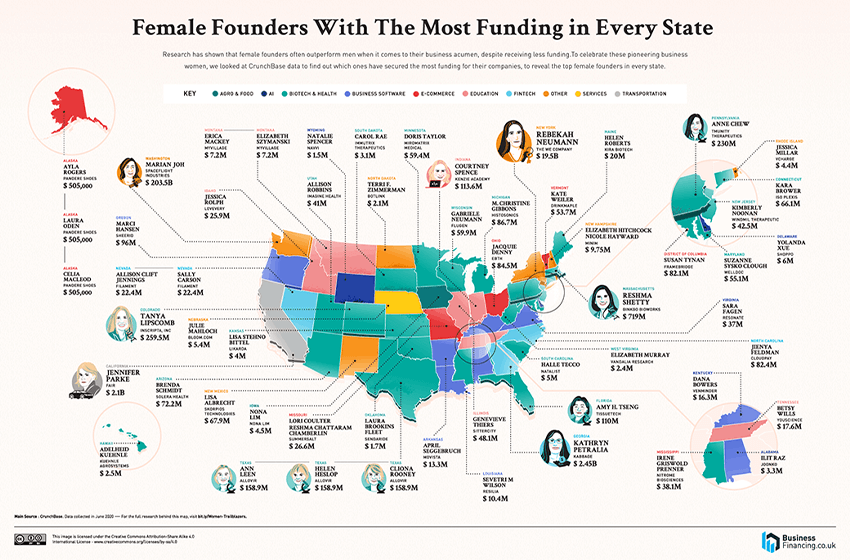

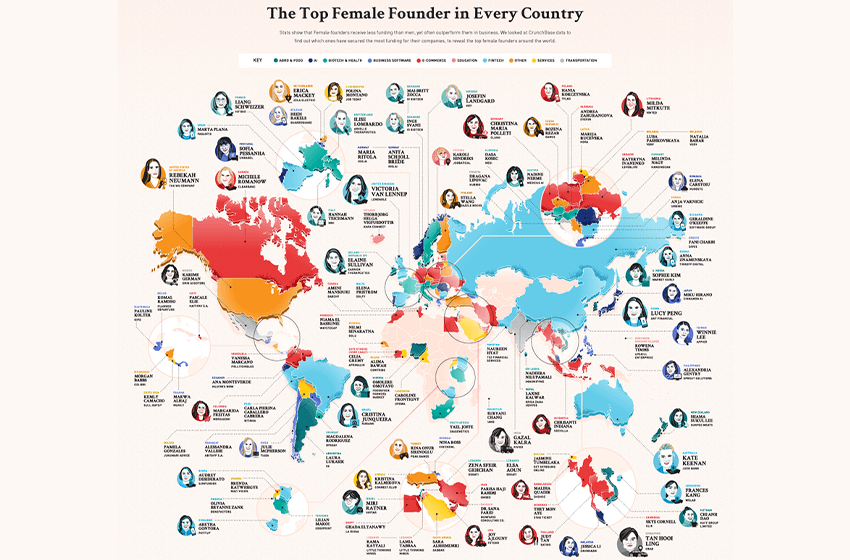

A new report from Business Financing.Co.UK titled, “The Top Female Founder In Every Country World Map” shows the leading female founders in each country. The map in the U.S. goes into more detail by showing the top founders in each state.

The company analyzed data from the Crunchbase business information resource to identify the top female founder. It then used the information to create maps with the leading female founders in the relevant states and countries.

In the end, the data set for the result contains 107 female founders and co-founders across 102 countries in the world. The U.S. data has 57 female founders from 50 states and Washington D.C.

Women Entrepreneurs in the U.S.

As the largest economy in the world, the female founders in the U.S. have better opportunities than many people in other countries. The result shows more multi-million/billion startups in the U.S. than any other country. And contrary to popular belief, they are not all in California and New York.

Each state has its own successful women business owners and founders responsible for business development in their communities.

The Top Ten Founders in the U.S.

Rebekah Neumann

The top female founder in the U.S. is Rebekah Neumann of The We Company at $19.5 billion. Neumann is a co-founder along with Adam Neumann and Miguel McKelvey. As We Work, a subsidiary of The We Company continues to grapple with the fiasco of its IPO plans falling apart in 2019, only time will tell where this company is heading. But it is fair to say Neuman will not be on top of the list this year. All of the founders since have stepped down and the company now has a new executive chairman.

Kathryn Petralia

Kathryn Petralia the Co-founder and President of Kabbage was named the ninth most powerful woman in finance by Forbes in 2017. In 2018 Petralia was named the Fintech Woman of the Year, again by Forbes. After raising $2.5 billion in funding, Kabbage was slated to be one of the leading online small business lenders in the U.S. However, the pandemic has changed all that.

In April of 2020 the company stopped lending money to small businesses. Kabbage said the biggest reason for this decision was small businesses couldn’t generate any income during the lockdowns around the country. On August 17, 2020, American Express announced it is buying Kabbage. The terms of the deal haven’t been disclosed, but it will close in late 2020.

Jennifer Parke

Jennifer Parke is a co-founder of Fair, a car leasing company in the car-as-a-service segment. To date, the company has raised $2.1 billion in funding.

Parke has extensive experience in art direction and design. Her background includes working for brands like Apple, Cisco, Old Navy and HBO to name a few. Additionally, Parke is responsible for establishing several companies: Sugar Shots, SubGiant, and Boombang Inc.,

Reshma Shetty

One of six founders of Ginko Bioworks, Reshma Shetty and her company has raised almost $720 million to date. This is a company that develops biological engineering products and custom microbes across multiple markets. Shetty received her Ph.D. in Biological Engineering from MIT and also has a B.S. in Computer Science from the University of Utah.

Biotech and health are the more inclusive industries when it comes to women founders. Twenty-three of the 57 women in the U.S. data are in these segments.

Tanya Lipscomb

In addition to being a co-founder at Inscripta, Tanay Lipscomb was also the Chief Technology Officer (CTO) and VP of R&D. To date, the company has raised $259 million. Inscripta is another biotech company developing the world’s first benchtop platform for scalable digital genome engineering.

Since 2018 Lipscomb has moved on to as Biotechnology Entrepreneur and Advisor for The Novo Nordisk Foundation Center for Biosustainability and Chief Technology Officer for Artisan Biotechnologies. She holds a PhD. in Chemical & Biological Engineering from the University of Colorado Boulder and a BS in Chemical Engineering from Kansas State University.

Other Female Founders on the U.S. List

Ayla Rogers, Laura Oden and Celia MacLeod

Even though they are the founders with the least amount of money on the list at $505,000 Ayla Rogers, Laura Oden and Celia MacLeod have a great business going with Pandere Shoes. Based in Alaska, the company has carved out a niche market in the industry, making adjustable ankle, mid-foot and toe box shoes. If you have wide feet, Pandere Shoes is the company for you.

Sevetri M. Wilson

With a total funding amount of $10.4 million, Sevetri M. Wilson is the CEO and Founder of Resilia. Wilson’s company provides organizations with on-demand tools that optimize operations and increase their effectiveness. It also simplifies the formation of new nonprofits.

The enterprise platform offers corporations, foundations, and government entities intuitive, data-driven software so they can leverage technology to accelerate impact and increase connectivity. Wilson holds MPP (Master of Public Policy) from Harvard University and a BA and MA from LSU in History and Mass Communications.

Jessica Rolph

From Idaho, Jessica Rolph is the CEO and co-founder of Lovevery, which has raised close to $26 million in funding. Rolph’s business is a new child development company helping parents ensure they are making the most of each learning stage. Rolph is also the co-founder and COO of Happy Family, the first organic brand to offer a line of organic foods for babies, toddlers and kids.

Rolph has an MBA from Cornell University – Johnson Graduate School of Management.

Suzanne Sysko Clough, MD

With more than $55 million, Suzanne Sysko Clough is another woman founder in the biotech and health sector. Dr. Clough was a co-founder and Chief Medical Officer of WellDoc. Dr. Clough since has co-founded Clough Health and Services and serves as Chief Medical Officer at QualityCare Connect and Amalgam.

Clough received her Doctor of Medicine degree from the University of Maryland School of Medicine.

Courtney Spence

As the co-founder and CMO of the Kenzie Academy, Courtney Spence’s company has raised over $113 million. Spence is a serial entrepreneur who also founded CSPence Group and Students of the World.

Spence is a Duke University graduate.

Global Woman Entrepreneurs

Globally the top female entrepreneurs represent several industries, but financial and fintech make up half of the founders.

The number one spot with $22 billion goes to China’s Lucy Peng, who is the executive chairman of Ant Financial Services. This is the online finance arm of Alibaba Group. At number two is the previously mentioned Rebekah Neumann from the U.S. followed by Tan Hooi Ling from Singapore with $9.9 billion as the co-founder of Grab. Grab is an app that provides transportation, logistics and financial services.

Kate Keenan from Australia is at number four with $1.4 billion as the co-founder and CMO for Judo Bank. And Victoria van Lennep from the U.K. rounds up the top five with $1.2 billion as co-founder of Lendable, a FinTech company.

Industries Representing Women Founders

Forbes reveals 32% of the 1,714 women founders in its report represent the software, biotech, and healthcare industries. Just as in this report biotech and healthcare segments represent female entrepreneurs in higher numbers. But women are in many industries and some of them have higher female entrepreneurs representation while others leave much to be desired.

In part, this has pushed women to bootstrap their business and grow from there. Female entrepreneurs who started a side hustle and grew it to become billion-dollar businesses are taking place more often. With the advent of the internet and social media, several women have turned their passions into businesses that are now unicorns.

Pat McGrath, a makeup artist, is one of the female entrepreneurs who now has a business with a billion-dollar valuation. Emily Weiss turned her side hustle, which was the blog Into the Gloss the vehicle for her make up line Glossier. The business now has a valuation of $1.2 billion.

Even though the billion-dollar valuation of a business gets the most attention, there are tens of thousands of female entrepreneurs that are successful. And not everyone measures success the same way. A founder in the non-profit segment has a much different goal than a fintech founder.

As long as a woman entrepreneur has the same opportunities they have shown they can grow their business to great heights. Experience, the right education and the guidance of some great mentors don’t hurt. But for most of the highly successful people on this list, it all starts with a solid education from a good school.

The Right School

When it comes to education, the school you go to will not determine the success of your business, but it can give you a heads up. Of the female founders, Medium kept track of in a report, 25% of them are represented by just eight undergraduate universities. What is more, only 10 graduate programs represent 59% of all capital raised by the top 300 female founders.

By company count, Harvard University, Stanford University, and Cornell University are the top three undergraduate institutions. And the top graduate programs by company count are Harvard Business School, Harvard University and The Wharton School at the University of Pennsylvania.

You can’t go wrong with a great education, but going to one of these schools is not a guarantee you will succeed. The business world is full of people without much education who are very successful. Hard work and determination have been responsible for the success of countless entrepreneurs. But for women, even a degree from these schools will not shield them from the bias they will face when looking for funding.

The Gender Bias in Venture Capital

There is undisputed data that shows female founders don’t get the same investment as their male counterparts from venture capital firms. According to the Curnchbase Q1 2019 Diversity Report 83% of venture dollars went to only male founders. And as mentioned previously, it is less than 3% for female only founders. But the bias goes even further. Women entrepreneurs are scrutinized in a much different way. Investors are more inclined to ask male entrepreneurs promotion-focused questions and female entrepreneurs prevention-focused questions.

Why is this so important? Because the study from the Academy of Management says it has a bearing on how much they raise. And it is resulting in divergent funding outcomes. The amount of those who were asked promotion-focused questions raised, “Significantly higher amounts of funding than those asked prevention-focused questions.”

The good news is entrepreneurial women are being recognized and supported for their hard work. The average seed round for female-only founded jumped to $1.2 million in 2019, which is almost the same as male founders at $1.35 million. Furthermore, there were 21 unicorns in that last year founded by female entrepreneurs, these are startup businesses with a value of more than $1 billion.

At the end of the day, investors are looking to increase their investment and gender should not play a role in how good an idea is. If all the data points to a great investment, then women should get the funding just like men. After all, female entrepreneurs are delivering better returns for each dollar invested. And this is driving the growth of female founders globally.

The 2020s: The Decade of Growth for Female Founders

The first quarter of 2020 started out with a bang for female founders. A record-tying $5.2 billion (Q2 2019) of capital was invested with 629 deals. This according to Pitchbook’s VC Female Founders Dashboard analysis. The great start in 2020 was driven by a stellar 2019 in which female founders raised $17.2 billion.

However, the pandemic put a damper in the optimism of the new decade with the third quarter delivering only $1.8 billion in investments compared to $4.9 billion in 2019. But this one in a lifetime incident shouldn’t change much of the growth that has taken place in the 2010s.

To put the growth of the past decade in context, the amount of capital investment for female founders was a mere $442 million in Q1 of 2010. And the deal count was 151. Each subsequent quarter and year experienced impressive growth peaking with the $5.2 billion of the first quarters of 2019 and 2020. Without the curveball of the pandemic, there was a great chance 2020 would’ve been a record year for funding for female entrepreneurs.

When things go back to normal, female and male VCs have to work even harder to get more female founders the capital they need. And it will require both their efforts to close the huge funding gap that currently exists. But first, they have to overcome a big hurdle to get more woman decision-makers in the VC ecosystem. Pitchbook says in 2019 only 12% of venture capital decision-makers in the U.S. were women.

Because general partners (GPs) in VCs control the use of capital as well as management and operations in a venture firm, having female GPs will at the very least give female entrepreneurs a better chance of having their ideas heard.

Conclusion

For venture capital firms that are only investing a minuscule percentage on female-only founders, they are missing out. How much are they missing out on? According to Morgan Stanley, to the tune of $1 trillion by simply overlooking people of different gender and cultures.

Feature Image: Depositphotos.com