Challenges of Services Sector SMEs in a Developing Country: A Case of Ghana

Apr 7, 2022 | The Latest

Challenges of Services Sector SMEs in a Developing Country: A Case of Ghana

Thursday, April 7, 2022, by Afia Serwaa Attrams & Makgopa Tshehla

School of Business Leadership, University of South Africa, College of Graduate Studies

Abstract

Small and medium-sized enterprises (SMEs) face diverse challenges that require solutions to enable the sector to thrive. The study used a sector-based approach to assess the challenges of SMEs from the financial institutions’ and SMEs’ points of view and suggested solutions to the challenges with a focus on the service sector in Ghana. The findings revealed that diversion of funds, inconsistencies in business, and lack of documentation prevail and are curbed by using mobile banking, improving relationship banking, and monitoring. From the analysis of 688 SMEs, high taxes and informal competitions are the highest-ranked challenges, while access to finance is ranked tenth. The policy recommendation is to reduce SME taxes and ban the importation of inferior goods.

Background

Small and medium-sized enterprises (SMEs) are the engines of economic growth in most developing countries. They contribute significantly to employment and the country’s Gross Domestic Product (GDP) and create incomes for individuals and households (Abor & Biekpe, 2006; Abor & Quartey, Abor and Quartey, 2010a). Due to their significant contributions to employment in most economies, they have proven that small businesses do really matter and developing economies especially cannot be without them (Radic, 2020). The service sector in Ghana is the largest of the three sectors (including manufacturing and agriculture). The trading (wholesale and retail trade) subsector constitutes the majority of business engagements in the services subsector according to the Ghana Statistical Service (GSS, 2018). The other subsectors include transport, information technology, hospitality, health, and education (among others). SMEs face diverse challenges (Asare, 2014; Ayyagari et al., 2017) that hinder their growth potentials (Abor & Quartey, 2010b; Ayandibu & Houghton, 2017). Although these challenges have been discussed in the literature extensively with diverse solutions (Donbesuur et al., 2020; Mamman et al., 2019; Quartey et al., 2017), they have mostly covered SMEs in general, but Seidel-Sterzik et al. (2018) have suggested a sector-based approach in tackling SME challenges. Some of the challenges identified include high cost of renting premises, high cost of income and property taxes, low investment capital (Mabe et al., 2013), access to credit (Brixiová et al., 2020), and the need for SMEs to improve on their internal ability to source for resources (Rita & Huruta, 2020). Oppong et al. (2014) contributes to the debate on SME challenges and suggests that there is a gap on how to plan, direct, control, and effectively market and strategize for their business on the part of SMEs which requires training interventions from government and non-governmental organizations.

SME owners are characterized with low capacity to manage their businesses, among other constraints (Abor & Quartey, Abor and Quartey, 2010a), and this requires the ability to understand their intellectual capital to enhance their performance (Demartini & Beretta, 2020) and invest in resources to build and maintain their networks to enhance their scope of business (Masiello & Izzo, 2019). They are further characterized by their owners who tend to lead their business operations when they are small family businesses but, as the business grows, the capacity to manage it by the family diminishes and reverts to nonfamily managers, depending on their intellectual orientation (Bauweraerts et al., 2021). Moreover, their financing decisions in terms of reinvesting in the business are affected by the local governance environment and the source of external financing (Nguyen, 2018). They are mostly financed by external sources (Beck & Demirgüç-kunt, 2008), mainly financial institutions (FIs) who, although challenged by SMEs information asymmetry, tend to use a relationship banking approach to still extend credit to them even in challenging situations (Calabrese et al., 2020). The challenges of SMEs presents an opportunity for research leading to policy directives especially for the benefit of developing economies.

Methodology

For the qualitative aspect of the study, seven FIs were interviewed using a semistructured interview guide to obtain information on their challenges in lending to SMEs and how they have been able to overcome those challenges. The qualitative study was followed by a quantitative study where data were collected from 688 SMEs, the majority of whom were in the service sector in the Accra and Kumasi localities in Ghana. The questionnaire was divided into sections, with section A on the demographics of the participants. To address the objective of the study, participants had to select from a list of 16 challenges the degree to which each was an obstacle to their business, using a five-point Likert scale from no obstacle to very severe obstacle. The views on how the challenges can be overcome were also obtained.

Findings

The FIs discussed the challenges they encounter when they grant credit to SMEs, and these have been outlined in this section. Furthermore, the challenges of SMEs in the service sector have been weighted and discussed with implications for theory and/or policy.

FIs’ challenges and way out with SMEs

The FIs identified six main challenges they encounter in their dealings with SMEs in the service sector. Diversion of funds has been identified as one challenge. According to FIs, SMEs easily change their minds about the purpose of credit facilities granted them once the funds have been disbursed and especially if it is in the form of working capital or overdraft. They further engage in multiple banking, where they borrow from one bank and move the funds into another bank for another purpose. Another challenge that leads to the diversion of funds is inconsistencies in business dealings by SMEs in the service sector. Because these businesses are small and the ownership is vested in mostly one man with little structure in place, they tend to make business decisions in an ad-hoc manner without recourse to their FIs who have extended credit facilities to them. They tend to acquire assets and enter into business deals with little consideration of the implications for their business. Furthermore, FIs are challenged by the lack of succession planning of SMEs such that in the absence of the main promoter of the business, the activities come to a halt and in some cases where death occurs, the business closes down with loans not being repaid. In addition, FIs are challenged by the lack of documentation by the SMEs, which tends to affect the financing decisions to extend or renew existing credit to these SMEs. Poor management capacity and the informal structure of SMEs in the service sector also pose a challenge to FIs as, in their financial inclusion approach, SMEs who can access banking services are those who have registered their businesses, have proof of addresses, and can be reached via mobile phones or e-mails. This, therefore, excludes some of the SMEs from being banked.

Despite the challenges FIs encounter with SMEs, they intimated that they do find SMEs profitable, as a majority of their bank portfolio is made up of SMEs. Hence, FIs have adopted some techniques in being able to lend to SMEs. These include the use of mobile banking, especially for traders who tend not to leave their shops. The mobile bankers visit them in their locations to both collect deposits or give credit. The use of insurance cover as part of securities when they lend to opaque SMEs, building closer relationships with their SME customers to reduce information asymmetry challenges, and developing basic financial information for the SMEs using their bank account operations to JOURNAL OF THE INTERNATIONAL COUNCIL FOR SMALL BUSINESS 3 determine ability to repay a credit are all approaches used by FIs to lend to SMEs. Finally, FIs have concluded that improving due diligence and bank account monitoring is one of the ways they can lend to SMEs successfully.

Service-sector SMEs challenges and the way out

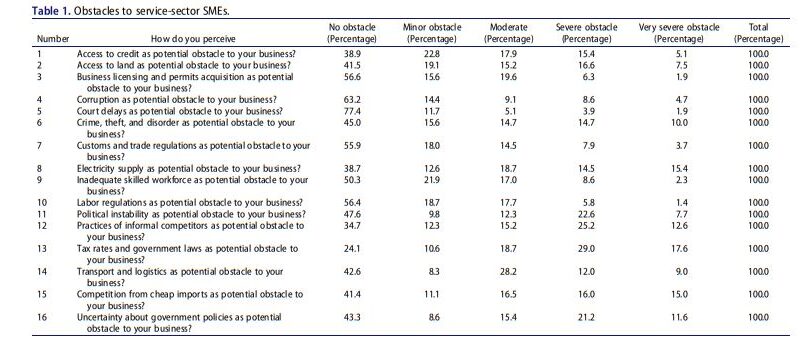

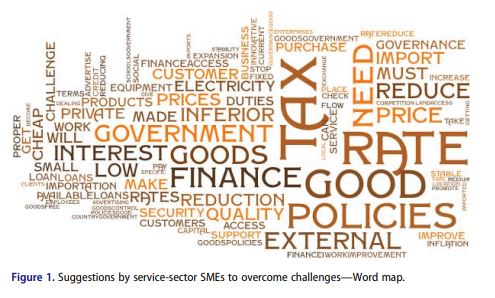

For the quantitative aspect of the study, participants were given a list of 16 obstacles that SMEs face and asked to select their perceived level of severity of the obstacles to their businesses on a five-point Likert scale from no obstacle to very severe obstacle. The obstacles and the level of severity are listed in Table 1. The researchers then combined the percentage of participants who selected severe obstacle and very severe obstacle for each item and ranked the obstacles in Table 2 to determine how the obstacles had been rated by SMEs and the implications thereon. From Table 2, the highest-rated obstacle was tax rates and government laws with 46.65 percent of participants perceiving this as the biggest challenge to their businesses. Practices of informal competitors was the second most rated obstacle, perceived by 37 percent of the participants as either a severe or very severe obstacle to their business. Uncertainty about government policies and competition from cheap imports were ranked third and fourth respectively. Political instability due to changes in government and electricity were fifth and sixth, while crime, theft, and disorder and access to land followed. Access to finance was ranked 10th. Court delays (5.78 percent), followed by labor regulations (7.18 percent) and business licenses and permits (8.23 percent) were the least rated perceived obstacle to service-sector SMEs. The suggested solutions to the challenges by the participants as outlined in a word cloud in Figure 1 includes government’s reduction in taxes, consistent policies, control of the importation of inferior goods, government to deal with the inflation rate, stability of the Cedi, access to cheap sources of funds, ability to market goods and services, the need for trained personnel, and ensuring regular power supply, among others.

Implications for theory and practice

Governments and institutions are making an effort to ensure there is financial inclusion of businesses and individuals through innovative approaches (Senyo & Osabutey, 2020), the availability of credit to SMEs (Lu et al., 2020), and development of entrepreneurship ecosystems as a mechanism to enhance development in the wake of a global health pandemic (Liguori & Bendickson, 2020). This study has helped to identify the challenges faced by service-sector SMEs. The implication is that policies and solutions to SMEs’ challenges should be tackled from the top down according to the rankings of the challenges identified in this study. Figure 2 outlines the challenges and solutions of service-sector SMEs from both FIs’ and SMEs’ point of view and provides implications if tackled by the responsible institutions. For service-sector SMEs to be sustainable and continue to be the engines of economic growth, it is recommended that government and other stakeholders use the challenges identified and the solutions as part of their development of the service-sector SMEs. This will have diverse implications on ease of doing business, growth of SMEs, improved access to funding, and growth in the GDP.

Disclosure statement

No potential conflict of interest was reported by the author(s).

References

Abor, J., & N. Biekpe. (2006). Small business financing initiatives in Ghana. Problems and Perspectives in Management, 4(3), 69–77. https://www.researchgate.net/profile/Nicholas[1]Biekpe/publication/265484299_Small_Business_Financing_Initiatives_in_Ghana_1/links/ 54e6f2990cf277664ff760a2/Small-Business-Financing-Initiatives-in-Ghana-1.pdf

Abor, J., & P. Quartey. (2010a). Issues in SME development in Ghana and South Africa. International Research Journal of Finance and Economics, 39(January), 218–228. https:// www.smallbusinessinstitute.co.za/wp-content/uploads/2019/12/ IssuesinSMEdevelopmentinGhanaandSA.pd f

Abor, J., & P. Quartey. (2010b). Issues in SME development in Ghana and South Africa. International Research Journal of Finance and Economics, 39(39), 218–228. Asare, A. O. (2014). Challenges affecting SME’s growth in Ghana.

Asare/OIDA International Journal of Sustainable Development, 7(6), 23–28. http://www.ssrn.com/link/OIDA

Ayandibu, A. O., & J. Houghton. (2017). The role of small and medium scale enterprise in local economic development (LED). Journal of Business and Retail Management Research, 11(2), 133–139. https://www.proquest.com/scholarly-journals/external-forces-affecting-small-busi nesses-south/docview/2028982053/se-2?accountid=14648

Ayyagari, M., V. Maksimovic, & A. Demirgüç-Kunt. (2017, November 14). SME finance. World Bank Policy Research Working Paper No. 8241. SSRN.

Bauweraerts, J., C. Pongelli, S. Sciascia, P. Mazzola, & A. Minichilli. (2021). Transforming entrepreneurial orientation into performance in family SMEs: Are nonfamily CEOs better than family CEOs? Journal of Small Business Management, 1–32. https://doi.org/10.1080/ 00472778.2020.1866763

Beck, T., & A. Demirgüç-kunt. (2008). Access to finance : An unfinished Agenda. The World Bank Economic Review, 22(3), 383–396. https://doi.org/10.1093/wber/lhn021

Brixiová, Z., T. Kangoye, & T. U. Yogo. (2020). Access to finance among small and medium[1]sized enterprises and job creation in Africa. Structural Change and Economic Dynamics, 55 (December): pp 177–189 .

Calabrese, R., M. Degl’Innocenti, & S. Zhou. (2020). Expectations of access to debt finance for SMEs in times of uncertainty. Journal of Small Business Management, 1–28. https://doi.org/ 10.1080/00472778.2020.1756309

Demartini, M. C., & V. Beretta. (2020). Intellectual capital and SMEs’ performance: A structured literature review. Journal of Small Business Management, 58(2), 288–332. https://doi.org/10.1080/00472778.2019.1659680

Donbesuur, F., G. O. A. Ampong, D. Owusu-Yirenkyi, & I. Chu. (2020). Technological innovation, organizational innovation and international performance of SMEs: The moderating role of domestic institutional environment. Technological Forecasting and Social Change, 161(February), 120252. https://doi.org/10.1016/j.techfore.2020.120252

Liguori, E., & J. S. Bendickson. (2020). Rising to the challenge: Entrepreneurship ecosystems and SDG success. Journal of the International Council for Small Business, 1(3–4), 118–125. https://doi.org/10.1080/26437015.2020.1827900

Lu, Z., J. Wu, & J. Liu. (2020). Bank concentration and SME financing availability: The impact of promotion of financial inclusion in China. International Journal of Bank Marketing, 38(6), 1329–1349. https://doi.org/10.1108/IJBM-01-2020-0007

Mabe, D. M. K., F. N. Mabe, & F. Y. N. Codjoe. (2013). Constraints facing new and existing small and medium-scale enterprises (SMES) in greater accra region of GHANA. International Journal of Economics, Finance and Management, 2(1), 160–168.

Mamman, A., J. Bawole, M. Agbebi, & A. R. Alhassan. (2019). SME policy formulation and implementation in Africa: Unpacking assumptions as opportunity for research direction. Journal of Business Research, 97(April), 304–315. https://doi.org/10.1016/j.jbusres.2018.01. 044

Masiello, B., & F. Izzo. (2019). Interpersonal social networks and internationalization of traditional SMEs. Journal of Small Business Management, 57(S2), 658–691. https://doi.org/ 10.1111/jsbm.12536

Nguyen, B. (2018). Entrepreneurial reinvestment: Local governance, ownership, and financing matter. Academy of Management Proceedings, 2018(1), 13097. https://doi.org/10.5465/ AMBPP.2018.13097abstract

Oppong, M., A. Owiredu, & R. Q. Churchill. (2014). Micro and small scale enterprises development in Ghana. European Journal of Accounting Auditing and Finance Research, 2 (6), 84–97. https://www.eajournals.org/wp-content/uploads/Micro-and-Small-Scale[1]Enterprises-Development-in-Ghana1.pdf

Quartey, P., E. Turkson, J. Y. Abor, & A. M. Iddrisu. (2017). Financing the growth of SMEs in Africa: What are the contraints to SME financing within ECOWAS? Review of Development Finance, 7(1), 18–28. https://doi.org/10.1016/j.rdf.2017.03.001

Radic, D. (2020). Small matters! Journal of the International Council for Small Business, 1(1), 24–27. https://doi.org/10.1080/26437015.2020.1714357

Rita, M. R., & A. D. Huruta. (2020). Financing access SME performance: A case study from batik SME in Indonesia. International Journal of Innovation, Creativity and Change,12(12), 203–224.

Seidel-Sterzik, H., S. McLaren, & E. Garnevska. (2018). Effective life cycle management in SMEs: Use of a sector-based approach to overcome barriers. Sustainability (Switzerland), 10 (2), 1–22. https://doi.org/10.3390/su10020359

Senyo, P. K., & E. L. C. Osabutey. (2020). Unearthing antecedents to financial inclusion through FinTech innovations. Technovation, 98, 102155. https://doi.org/10.1016/j.technova tion.2020.102155

The Ghana Statistical Service (GSS). (2018). The Integrated Business Establishment Survey (IBES): Comprehensive Sectoral Report [online]. Available from: https://www2.statsghana. gov.gh/docfiles/publications/IBES/IBES%20II%20COMPREHENSIVE%20SECTORAL% 20REPORT.pdf