A continuación, en el formato de las nubes de palabras interpretativas, se presentan hallazgos desde los datos cualitativos de las respuestas abiertas de las encuestas GEM NES (a expert@s) aplicadas *, respectivamente en junio-agosto del 2019, y junio-agosto de 2020.

Antecedentes

El GEM es un estudio social ya que se considera que las personas son principales agentes del ecosistema regional de emprendimiento. Este se define como el conjunto de actores públicos y privados que creen y se relacionan entre sí en base de las instituciones formales e informales (normas, reglas de comportamiento), asimismo se refiere al espacio-tiempo organizacional en el cual los miembros muestran la intención explícita de fomentar el emprendimiento. De este modo, la metodología del GEM se enfoca en las personas, organizaciones y el fenómeno emprendedor y basa su metodología en el uso de encuestas que son aplicadas tanto a emprendedores (de cualquier tipo) como a expertos en el tema y conocedoras/conocedores de la realidad regional.

Principales hallazgos GEM NES 2019-2020

En La Araucanía, de 400 respuestas del nivel regional (GEM NES) validadas, 121 respaldan la posición del PNUD de la ONU sobre la resiliencia de los sistemas, en específico se refuerza la idea que la diversidad (biológica y cultural) de los socioecosistemas (por ejemplo, el ecosistema de emprendimiento regional) es esencial para resiliencia de los sistemas y sub-sistemas. Si bien la diversidad, al crear redundancia hace nuestros sistemas de emprendimiento y negocios menos eficientes, de igual modo aumenta la resiliencia (UNDP, 2020, p. 9), es decir la capacidad de anticipar los estresores exógenos, absorber sus impactos y adaptarse a las condiciones de desastres y crisis, para recuperar e incluso mejorar la actividad comercial de sus emprendimientos.

En segundo lugar, y en estrecha relación con lo mencionado anteriormente, se encuentra la relación entre datos, información, conocimiento y sabiduría (Kitchin, 2014, en Žebrytė et al., 2019), y rol de estos en la toma de decisiones por parte de las y los emprendedores y gestores de las MiPyMEs. Las y los expertos muestran la preocupación por la educación en general y emprendimiento en particular. Desde total de 400 respuestas 84 se referían a obstáculos, incentivos o recomendaciones directamente relacionadas con educación y formación ligada al emprendimiento. Igual que WEF reconocen que las y los profesionales de la región se encuentran preparados para el mercado laboral (WEF, 2020 a, p. 22), pero destacan falta de preparación para emprender o crear valor independientemente, desempeñarse en roles de liderazgo, ser personas desarrolladas integralmente; y por ello sugieren introducir ajustes a los procesos de enseñanza-aprendizaje desde el nivel de educación segundaria. Finalmente, reconocen que la diversidad e inclusión serian motores para lograr un ecosistema regional de emprendimiento más competitivo, incluso a nivel global, y robusto por las relaciones interculturales más profundas y de mutuo beneficio.

En tercer lugar, junto con lo anterior, se considera que desde el gobierno central y los medios de comunicación nacionales comparten información sesgada sobre la región, especialmente en cuanto los temas de relaciones interculturales, discriminación e inequidad estructural e histórica, y seguridad. Tal guerra de información crea imagen desfavorable del ecosistema regional de emprendimiento, e inhibe su desarrollo.

Desde los datos recopilados en 2019 y 2020, para 2021 y mediano plazo hemos aprendido que nuestro ecosistema regional de emprendimiento se encuentra simultáneamente débil y fuerte en cuanto la diversidad, equidad e inclusión, y que para la construcción del ecosistema resiliente se requiere incidir en el desarrollo sostenible a través del Emprendimiento Regional que se rige por los valores de diversidad, equidad e inclusión.

La Araucania cierra 2020 dando realce a diversidad, equidad e inclusión como valores para el funcionamiento del ecosistema regional de emprendimiento (datos GEM NES 2019 y 2020):

| ABC del emprendimiento regional |

Comprensión de los conceptos en 2020

(encuesta GEM NES aplicada en junio-agosto de 2020, en plena Pandemia de la COVID19 y después del Estallido Social, pero con plebiscito pendiente) |

Detalle y contraste con 2019

(encuesta GEM NES aplicada en junio-agosto de 2019, es decir antes del Estallido Social) |

| Asociatividad |

Reactivación de la economía, sector público brinda servicios profesionales y apoyo a emprendedores a cero costo, implementos y protocolos de higiene y salud. |

Encadenamiento, colaboración publico privada, solidaridad con Pueblo Mapuche en su lucha contra discriminación y criminalización. |

| Beneficio |

Impacto ambiental, económico y social positivo. Interés colectivo o público por sobre interés privado inmediato (tendencia hacia la sostenibilidad). |

Emprendimiento como solución para los problemas de acceso al bien estar en igualdad de condiciones. |

| Creatividad |

Creatividad en ciber espacios, Araucania Digital, creatividad desde cosmovisión de pueblos originarios. Nuevos e innovativos modelos de negocios. |

Industrias creativas (artes, diseño etc.), Smart City, creatividad en los souvenir y otros ítem “tangibles” que acompañan servicios de turismo, por ejemplo. |

| Descentralización |

Condiciones de vida en regiones que previenen expulsión del capital humano. |

Políticas públicas para el fomento de emprendimiento locales y regionales. |

| Educación |

Formar personas integrales y multifacéticas, con habilidades blandas y que se sienten bien tanto en roles de liderazgo y toma de decisiones, como empleados dependientes. |

Educación inclusiva se entiende por intercultural y dirigida a lograr la equidad de género. |

| Financiamiento |

Mayor énfasis en subsidios y recurso público para enfrentar a la pandemia o la llamada reactivación. Nuevamente se destaca la necesidad de los programas regionales para fomento de emprendimiento regional y dirigido a financiar “capital humano con pertinencia regional” (retención). |

Énfasis igual en el financiamiento público y privado con enfoque regional (flexibilidad acorde las necesidades regionales, tributación diferenciada para emprendimiento naciente versus establecido etc.). |

| Globalización |

Enfrentar la globalización desde las fortalezas de una regional plurinacional, a través de la digitalización del emprendimiento y MiPyMEs, y servicios públicos. |

Enfrentar la globalización desde las fortalezas locales/regionales, es decir la diversidad e inclusión entendidas como convivencia dirigida al bien estar de la sociedad plurinacional. |

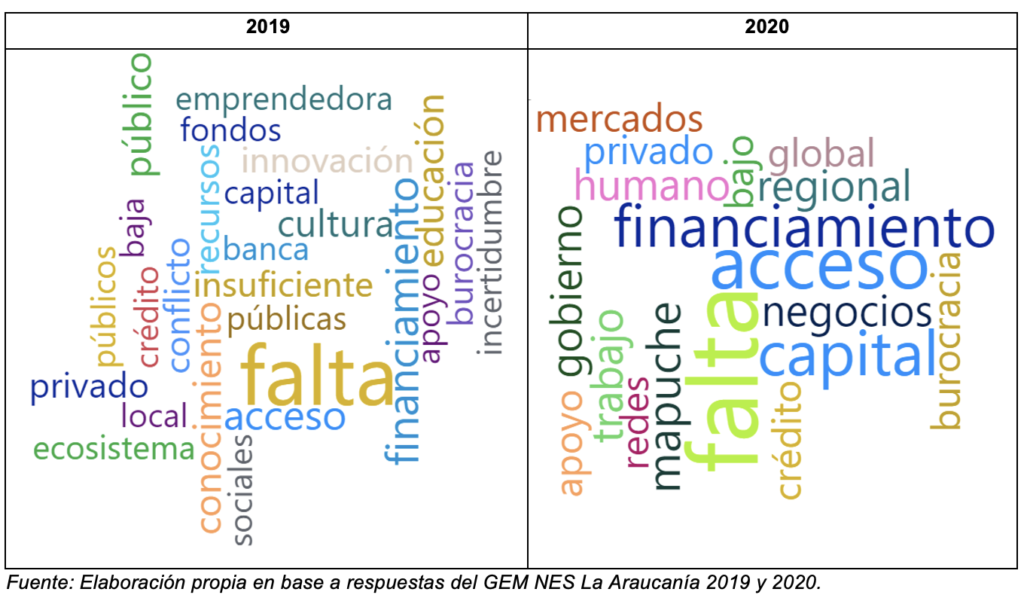

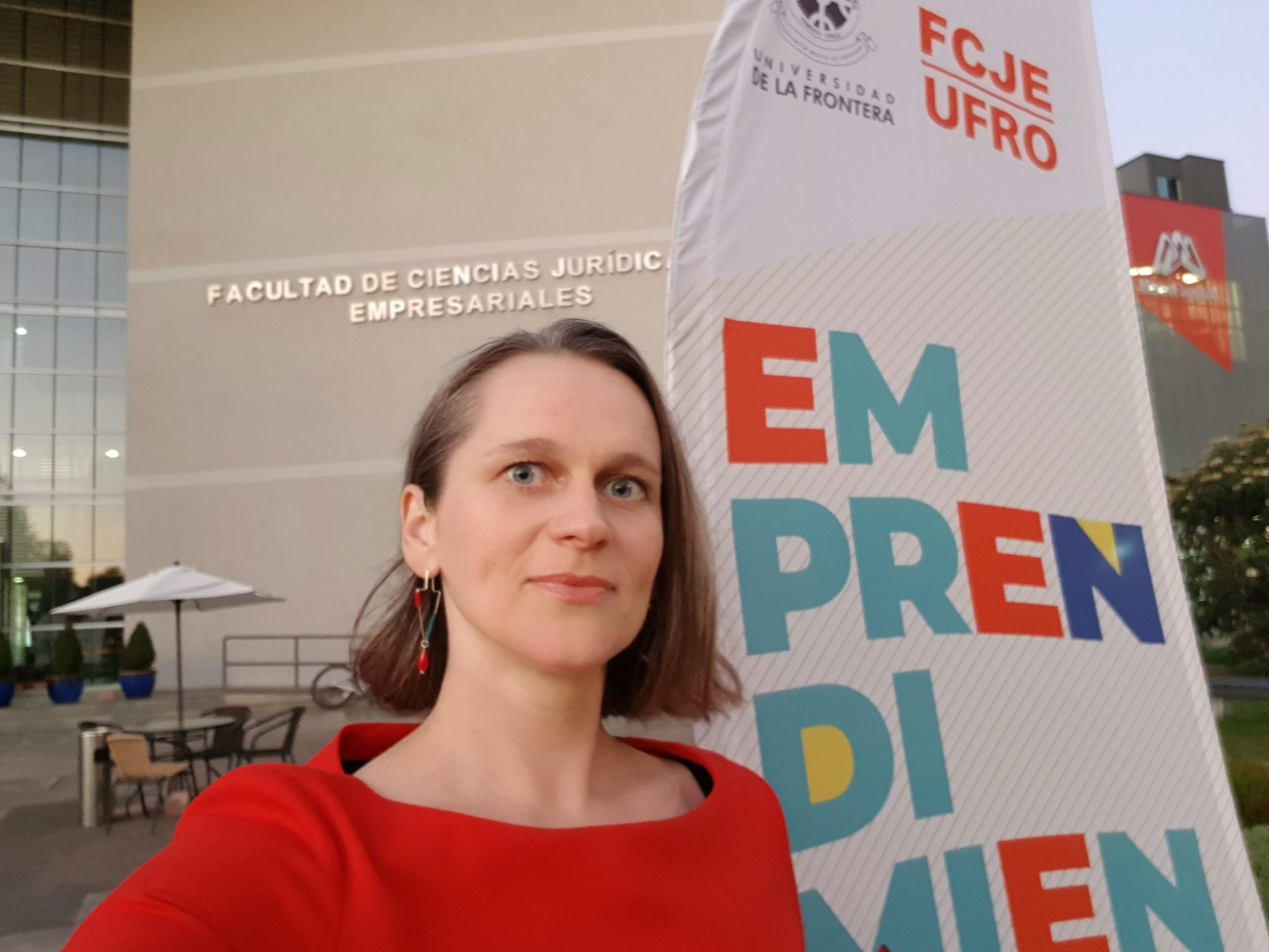

Figura 1. Nubes de Palabras sobre los factores que obstaculizan

el emprendimiento en la Región de La Araucanía, 2019 y 2020.

Como se aprecia en la figura 1, en ambos años la palabra más repetida como factor que obstaculiza el emprendimiento en la región de La Araucanía es “Falta”, seguido de “Acceso” y “Financiamiento”. Lo anterior, está en línea con la tendencia de la dimensión Apoyo Financiero como la peor evaluada a nivel nacional en ediciones anteriores del GEM (e.g. GEM regiones chilenas 2018 publicado en 2019).

Para el año 2020, los conceptos que dejaron de aparecer fueron los tres relacionados al sector público (“Públicos”, “Públicas” y “Público”), en cambio, aparece el concepto “Gobierno”. De esto se desprende que responsabilidad se traspasó de la administración pública a las autoridades de turno. Este cambio se puede atribuir al descontento de la sociedad civil con la política chilena que se ha manifestado desde octubre 2019. No obstante, hay que resaltar que el tamaño de “Gobierno” es menor que el conjunto de las variables de “Público”, por lo que el aporte del sector público al emprendimiento en la región ha ido aumentando.

“Educación” y “Conocimientos” son dos conceptos que dejan de aparecer para el 2020, y están asociados a la dimensión Educación para el Emprendimiento, una de las peor evaluadas a nivel nacional, pero que en el tiempo ha tenido leves mejorías. Otros conceptos que han dejado de aparecer, y por ende se desprende son ámbitos en los que se ha mejorado a nivel regional, son “Cultura” e “Innovación”.

Así como ha habido mejoras en algunos aspectos, hay otros que han surgido para el año 2020. De estos destacan: “Mapuche”, haciendo referencia a que emprendimientos de origen Mapuche tienen más dificultades o menos apoyo para surgir demás de constituir una oportunidad para fortalecer el sistema de emprendimiento regional; y “Capital” incrementó su tamaño y surgió el término “Humano”, haciéndose alusión a la fuga de capital humano que hay en la región y los pocos esfuerzos por retenerlo.

Los conceptos sin variación en su frecuencia fueron “Burocracia”, “Crédito” y “Privado”. En contexto de pandemia se podría esperar que existan mayores esfuerzos para disminuir el efecto negativo de estos factores, para reactivar la economía o acelerar procesos evitando aglomeraciones, pero la evidencia demuestra que no han tenido cambios sustanciales para dejar de considerarlos obstáculos para el emprendimiento.

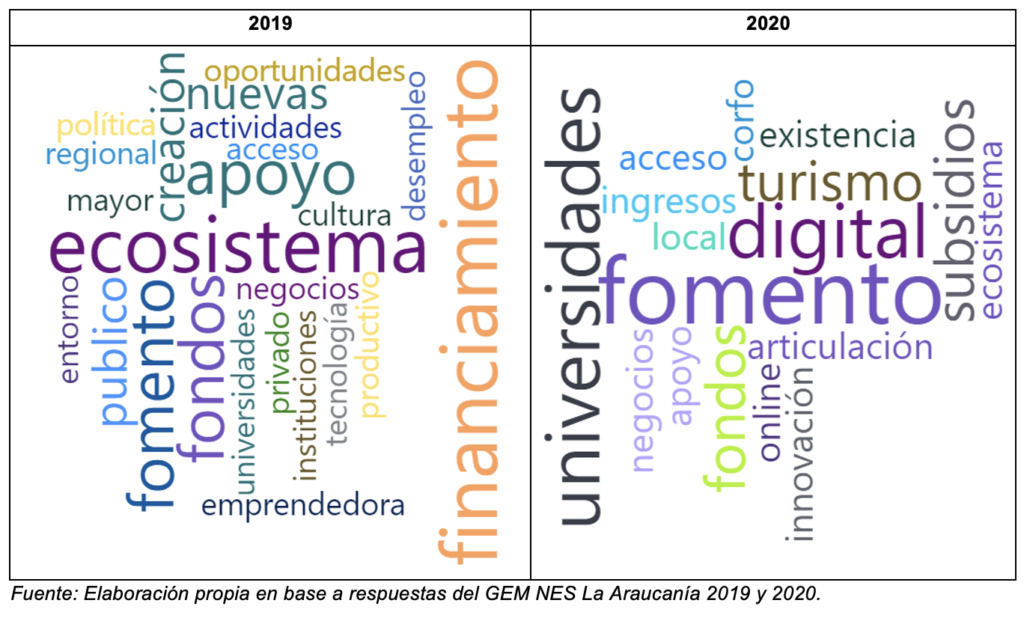

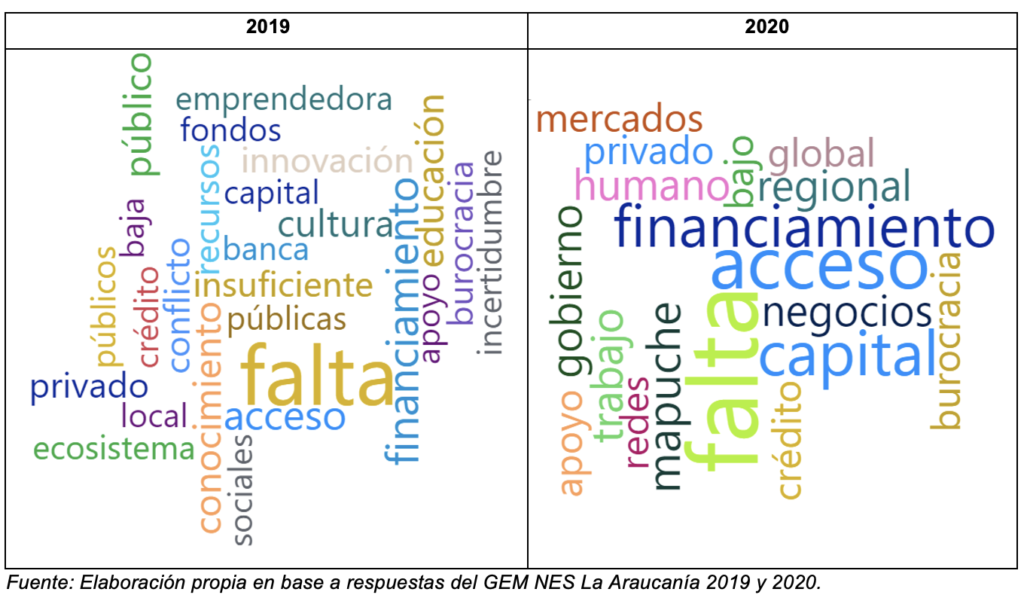

Figura 2. Nubes de Palabras sobre los factores que impulsan

el emprendimiento en la Región de La Araucanía, 2019 y 2020.

Si bien el “Financiamiento” fue el mayor obstáculo identificado por los expertos en el 2019, también fue el mayor impulsor del emprendimiento, junto con “Apoyo” y “Fondos”. La valoración de los expertos es favorable respecto a la existencia de suficiente oferta de subvenciones públicas; y otras alternativas de financiamiento han cobrado mayor relevancia entre los últimos años, como acceso a capital propio y proveniente de inversionistas informales (GEM Chile 2019 / Guerrero y Serey, 2020). Para el año 2020, el concepto financiamiento desaparece, pero de los conceptos relacionados se mantiene sin variación “Fondos” y aparece “Subsidios”. La pandemia tuvo consecuencias económicas que escapan del control de los emprendedores, por lo que expertos valoran que organismos públicos y privados tengan iniciativas que amortigüen estos efectos en el estado de resultado de las MiPyMEs (emprendimientos nacientes y consolidados en el tiempo).

En el 2019, los otros conceptos más relevantes fueron “Fomento” y “Ecosistema”. El ecosistema emprendedor regional está cada vez más consolidado y colaborativo, manteniéndose en crecimiento y desarrollo. Para el 2020, sigue destacando “Fomento”, seguido de “Universidades”, reflejando una mayor valoración del rol de estas, como ente que potencia el emprendimiento y que traspasa conocimiento desde la academia al ecosistema emprendedor regional. Otro ente que aparece para el 2020, es “CORFO”, que cumple un rol relevante en la reactivación de las MiPyMEs en la situación de la Pandemia de la COVID-19.

Las medidas preventivas por parte del gobierno contra el coronavirus, como el cierre del comercio no esencial para evitar el traslado de personas y las aglomeraciones, obligó a las empresas a adaptarse al mundo digital e innovar para subsistir. En el año 2020 destacan los conceptos “Digital”, “Online” e “Innovación” como impulsores del emprendimiento, porque, aunque no estaba contemplado con anterioridad, la región si contaba con los recursos humanos y tecnológicos necesarios para la adaptación.

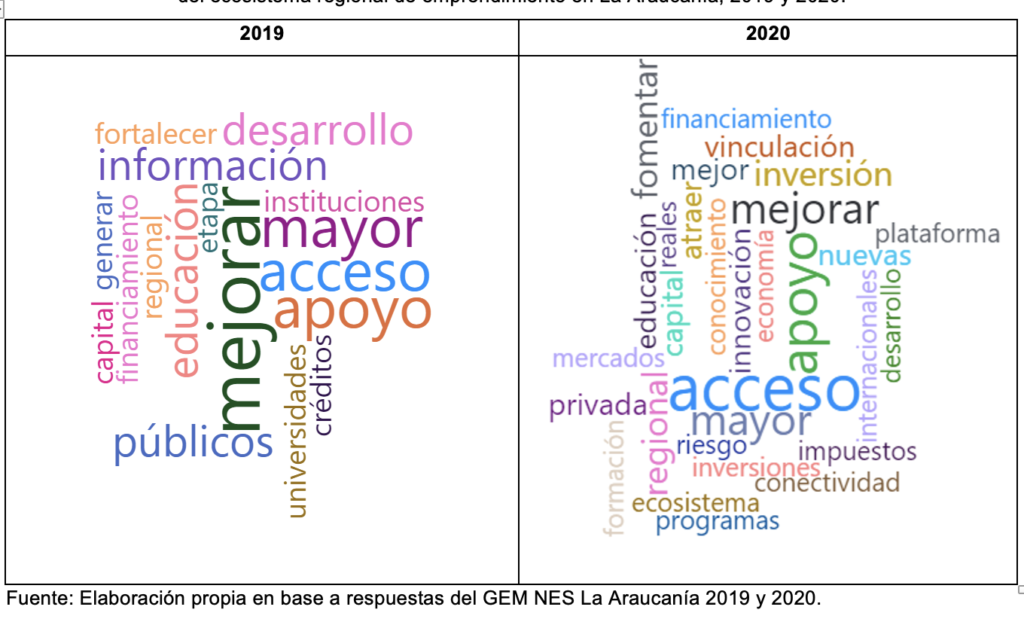

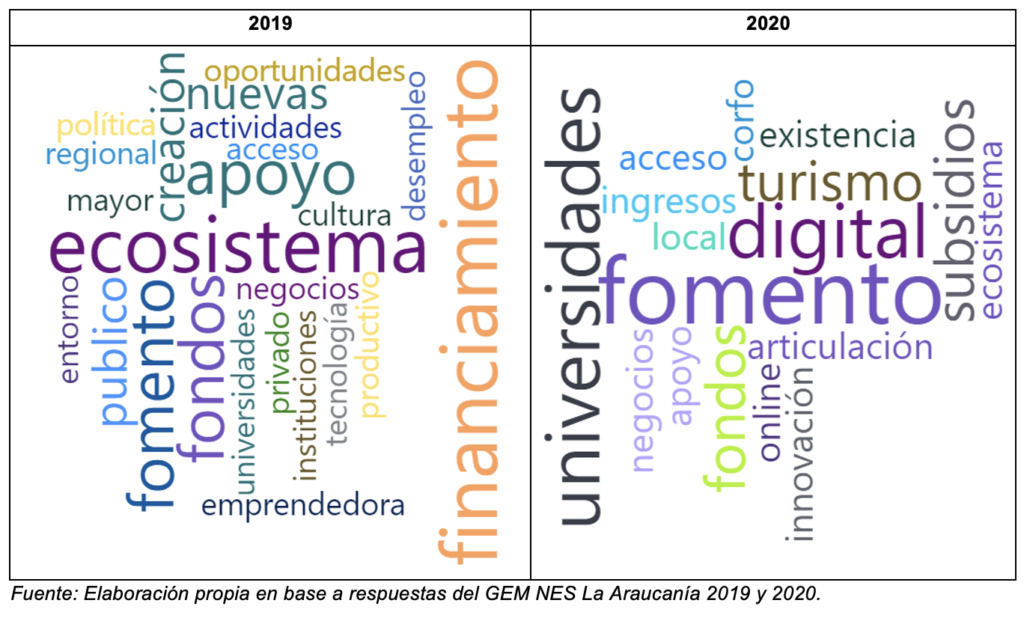

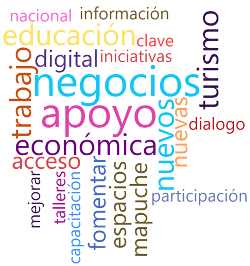

Figura 3. Nubes de Palabras sobre recomendaciones para la mejora del funcionamiento

del ecosistema regional de emprendimiento en La Araucanía, 2019 y 2020.

En ambos periodos los conceptos más mencionados son “Mejorar”, “Mayor”, “Acceso” y “Apoyo”. Se puede destacar que las recomendaciones están orientadas a mejorar factores existentes en la región, por tanto los esfuerzos se deben enfocar en perfeccionar lo que se tiene y no en generar nuevos instrumentos. Esto último implicaría una complejidad mayor, y posiblemente, un mayor desembolso en recursos financieros y tiempo.

Según datos del Observatorio Laboral de La Araucanía (2020 a) las MiPyMEs corresponden al 82.1% de las empresas de la región, concentrando el 48.2% de las ventas anuales y un 59.0% de trabajadores dependientes. A pesar de que la economía local esta invisibilizada, se espera que en momentos de crisis aportará la producción relevante en los territorios. Por ello, es necesario atraer “Inversión” a ellos, crear y fortalecer “Programas” y medidas de gobierno y privados en apoyo a las MiPyMEs, tener expectativas de crecimiento en nuevos “Mercados” nacionales e “Internacionales”.

En el 2019, los conceptos que siguen en relevancia fueron “Educación”, “Información” y “Desarrollo”, en cambio, para el 2020, siguen “Fomento”, “Inversión” e “Inversiones”. Es decir, las preocupaciones sobre las dimensiones de Educación y Transferencia I+D, a pesar de seguir siendo un área por mejorar, no resultan ser prioritarias sobre la situación actual.

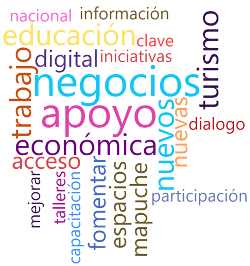

Figura 4. Nube de Palabras respuestas a preguntas sobre el Estallido Social y Pandemia de la COVID-19. Fuente: Elaboración propia en base a respuestas del GEM NES La Araucanía 2020.

Fuente: Elaboración propia en base a respuestas del GEM NES La Araucanía 2020.

Los emprendimientos nacientes, en transición y consolidados, ósea MiPyMEs, en particular se han visto afectados ya que cuentan con menos recursos para enfrentar esta seguidilla de adversidades -primero el Estallido Social y, luego la Pandemia de la COVID-19-. Para poder afrontar la situación actual los agentes del ecosistema emprendedor, del sector público y privado, deberían realizar un trabajo asociativo y colaborativo para la reactivación, razón por la que aparecen conceptos como “Participación”, “Dialogo”, “Iniciativas”, “Capacitaciones”, “Talleres” y “Espacios”. Es la percepción de l@s expert@s, que estas instancias se deben fortalecer para lograr la reapertura de todos sectores económicos, considerándose protocolos de medidas de seguridad sanitaria que sean factibles de llevar a cabo por los emprendedores, y adaptación del ecosistema y las empresas a la “Nueva Normalidad” logrando diversificación, equidad e inclusión -elementos necesarios para prosperidad sostenible-.

Según Encuesta Mensual de Alojamiento Turístico (EMAT), en La Araucanía las llegadas disminuyeron un 94.2%, las pernoctaciones un 94.6% en julio 2020 respecto al mismo periodo año anterior (INE, 2020). Según datos del Observatorio Laboral Araucanía (2020 b) un 58% de las empresas reportan una reducción en las ventas o ingresos con respecto al mismo mes del 2019. Dentro de las principales dificultades, destaca la disminución de clientes (84%), junto a la cancelación de proyectos o servicios y la falta de liquidez (70%). Por lo anterior, no es de extrañar la frecuencia del concepto “Turismo” y “Negocios”.

Asimismo, la OCDE (2020) afirma que con las medidas de contención que se relajaron gradualmente desde julio, los indicadores a corto plazo sugieren que la actividad económica ha comenzado a recuperarse, en particular las ventas minoristas y la producción manufacturera, mientras que el turismo y la hostelería continúan siendo débiles.

Por último, hay que destacar que al igual que en todas las nubes de palabras anteriores, considerando ambos años, en esta también se repiten con alta relevancia los conceptos de “Acceso” y “Apoyo”. Lo que da a entender que existe acceso y apoyo en varias de las dimensiones evaluadas, pero no a un nivel suficiente para hacer crecer y fortalecer el ecosistema emprendedor y para preparar a los emprendedores ante desastres y crisis.

Haga clic aquí para más detalles

Referencias

Amorós, J.E., Guerrero, M. & Naranjo-Priego, E.E. (2020) COVID-19 Impacts on Entrepreneurship: Chile and Mexico. In Ionescu-Somers, A. & Tarnawa, A. (eds.) Diagnosing COVID-19 Impacts on Entrepreneurship Exploring policy remedies for recovery. GEM and Shopify.

Charmaz, K. (2014). Constructing grounded theory. Sage.

Guerrero, M., & Serey, T. (2020) Global Entrepreneurship Monitor. Reporte Nacional de Chile 2019. Universidad del Desarrollo, Santiago de Chile.

ICSB (2020) Global MSMEs report 2020. Washington D.C.

INE (2020). Encuesta Mensual de Alojamiento Turístico. Edición n° 262. Recuperado en www.ine.cl/docs/default-source/actividad-del-turismo/boletines/2020/bolet%C3%ADn-encuesta-mensual-de-alojamiento-tur%C3%ADstico-(emat)-julio-2020.pdf

Kim, P. H., Wennberg, K., & Croidieu, G. (2016). Untapped riches of meso-level applications in multilevel entrepreneurship mechanisms. Academy of Management Perspectives, 30(3), 273-291.

Observatorio Laboral Araucanía (2020 a). Impacto del COVID en la economía mundial y local. Recuperado en www.observatorioaraucania.cl/descargas/

Observatorio Laboral Araucanía (2020 b). Situación Empresas ante la crisis sanitaria. Recuperado en www.observatorioaraucania.cl/descargas/

OCDE (2020). Perspectivas económicas de la OCDE, volumen 2020, número 2. Recuperado en https://www.oecd-ilibrary.org/sites/39a88ab1-en/1/3/3/8/index.html?itemId=/content/publication/39a88ab1-en&_csp_=fd64cf2a9a06f738f45c7aeb5a6f5024&itemIGO=oecd&itemContentType=issue

OECD (2019), OECD SME and Entrepreneurship Outlook 2019, OECD Publishing, Paris, https://doi.org/10.1787/34907e9c-en.

Rheinhardt, A., Kreiner, G. E., Gioia, D. A., & Corley, K. G. (2018). Conducting and publishing rigorous qualitative research. Cassell C., Cunliffe AL, & Grandy G. The Sage Handbook of Qualitative Business and Management Research Methods. Sage.

UNDP (2020). Human Development Report 2020. The next frontier Human development and the Anthropocene. NY, USA.

World Economic Forum (2020 a) The Global Competitiveness Report. Switzerland.

World Economic Forum (2020 b) The Global Risks Report 2020. Insight Report 15th Edition. In partnership with Marsh & McLennan and Zurich Insurance Group. Switzerland.