Around 1870BC, in the city of Assur in northern Iraq, a woman called Ahaha uncovered a case of financial fraud.

Ahaha had invested in long-distance trade between Assur and the city of Kanesh in Turkey. She and other investors had pooled silver to finance a donkey caravan delivering tin and textiles to Kanesh, where the goods would be exchanged for more silver, generating a tidy profit. But Ahaha’s share of the profits seemed to have gone missing – possibly embezzled by one of her own brothers, Buzazu. So, she grabbed a reed stylus and clay tablet and scribbled a letter to another brother, Assur-mutappil, pleading for help:

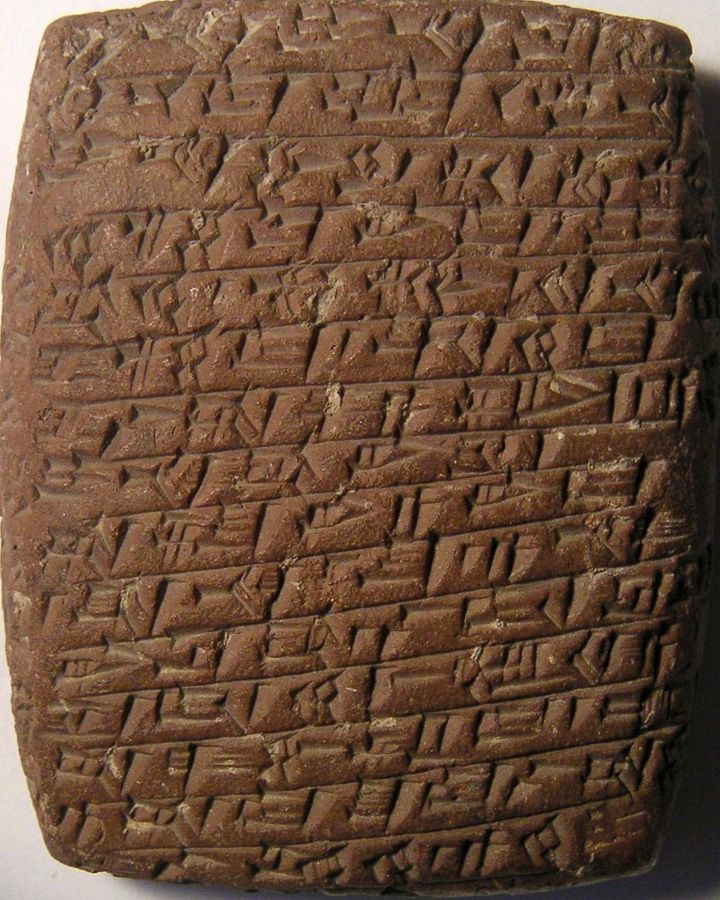

“I have nothing else apart from these funds,” she wrote in cuneiform script. “Take care to act so that I will not be ruined!” She instructed Assur-mutappil to recover her silver and update her quickly. “Let a detailed letter from you come to me by the very next caravan, saying if they do pay the silver,” she wrote in another tablet. “Now is the time to do me a favour and to save me from financial stress!”

Ahaha’s letters are among 23,000 clay tablets excavated over the past decades from the ruins of merchants’ homes in Kanesh. They belonged to Assyrian expats who had settled in Kanesh and kept up a lively correspondence with their families back in Assur, which lay six weeks away by donkey caravan. A new book gives unprecedented insight into a remarkable group within this community: women who seized new opportunities offered by social and economic change, and took on roles more typically filled by men at the time. They became the first-known businesswomen, female bankers and female investors in the history of humanity.

‘Strong and independent’

The bulk of the letters, contracts and court rulings found in Kanesh date from around 1900-1850 BC, a period when the Assyrians’ trading network was flourishing, bringing prosperity to the region and giving rise to many innovations. The Assyrians invented certain forms of investment and were also among the first men and women to write their own letters, rather than dictating them to professional scribes. It’s thanks to these letters that we can hear a chorus of vibrant female voices telling us that even in the distant past, commerce and innovation were not the exclusive domains of men.